Focused on Core Plus and Value-Add investments in high-growth markets across the Southwest and Southeast, the Fund aims to enhance asset value and drive attractive risk-adjusted returns for investors.

Join Brian McGlynn, Chief Investment Officer at Rincon Partners, as he provides a strategic overview and market analysis. This in-depth discussion highlights key investment opportunities, economic trends, and Rincon’s disciplined approach to value creation.

Rincon Partners has successfully acquired and managed over $1 billion in multifamily assets, demonstrating a track record of disciplined execution.

Gain exposure to a diverse portfolio of stable, appreciating properties in high-demand metro areas.

We focus on income-producing assets with the potential for significant capital appreciation.

We focus on income-producing assets with the potential for significant capital appreciation.

Targeting multifamily investments in Phoenix, Tucson, Denver, Atlanta, Charleston, Savannah, Charlotte, Raleigh-Durham and other select Sun Belt metros with strong job growth, positive demographic tailwinds, and improving apartment metrics.

Up to $100 million in Class A Units

$50,000 (additional investments in $5,000 increments)

Target loan-to-value ratio of 50-60%

3-5 years per property, allowing for an optimized exit strategy

Up to $100 million in Class A Units

$50,000 (additional investments in $5,000 increments)

Target loan-to-value ratio of 50-60%

3-5 years per property, allowing for an optimized exit strategy

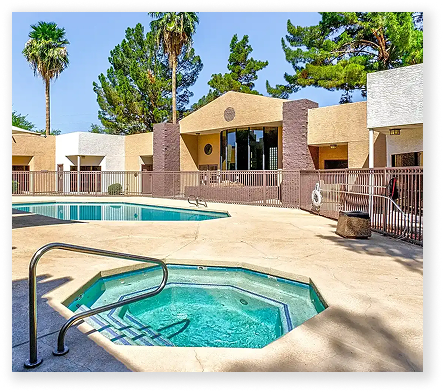

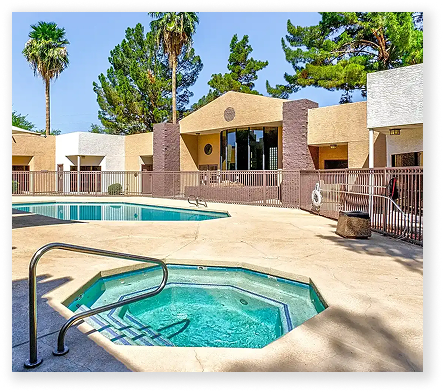

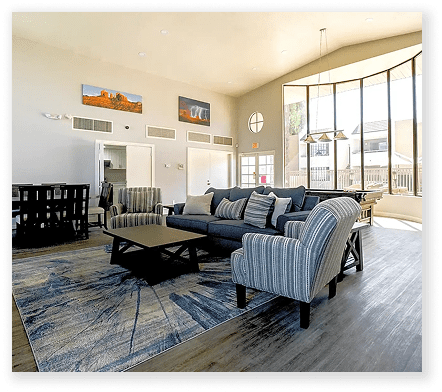

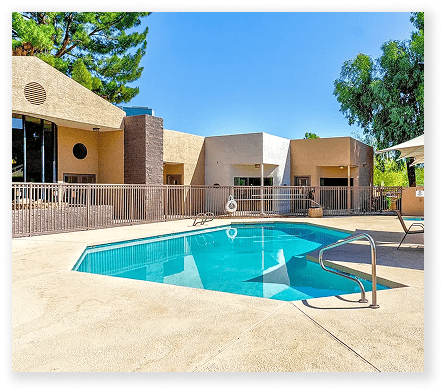

As part of Rincon Multifamily Fund II, we recently acquired Ascent on Spence (formerly Rancho Las Palmas), a 112-unit value-add multifamily community in Tempe, Arizona.

Just 0.75 miles from Arizona State University and positioned near major employment corridors, this property exemplifies our strategy—acquiring high-quality assets with strong appreciation potential in vibrant urban markets.

John Feely

Rincon Multifamily Fund II, LLC partners with FLX Networks, a leader in financial services distribution.

As a registered Promoter under the U.S. Investment Advisers Act of 1940, FLX Networks provides a streamlined investment experience while maintaining institutional-grade standards.

For details on investing through FLX Networks, contact:

This is not an offer to sell or a solicitation to buy securities. Any offering is made only through the Confidential Private Placement Memorandum, which details important information about risks, fees, and investment terms. Past performance does not guarantee future results. Please consult with your financial advisor before making an investment decision.